Inside EU Health: Pharma and biotech lead in public research patents; and, EFPIA cautiously optimistic on clinical trials reform

Pharma and biotech lead in public research patents; and, EFPIA cautiously optimistic on clinical trials reform

Pharma and biotech are top in public research patents

A study from the European Patent Office (EPO) Observatory on Patents and Technology has highlighted the role of Europe’s public research organizations (PROs) in enhancing Europe’s competitiveness and innovation capacity.

According to EPO President António Campinos, public research remains “one of Europe’s greatest strengths,” but adds that unlocking its full potential requires stronger collaboration and faster transfer of research into real-world technologies.

Europe PROs have made a significant contribution to patenting activity, filing nearly 63,000 patent applications with the EPO between 2001 and 2020. PRO-related academic patents are highly concentrated in science-based fields, particularly biotechnology and pharmaceuticals, which together account for 27.6% of these patents. The study revealed that PROs are now far more proactive in managing and commercializing their intellectual property than universities.

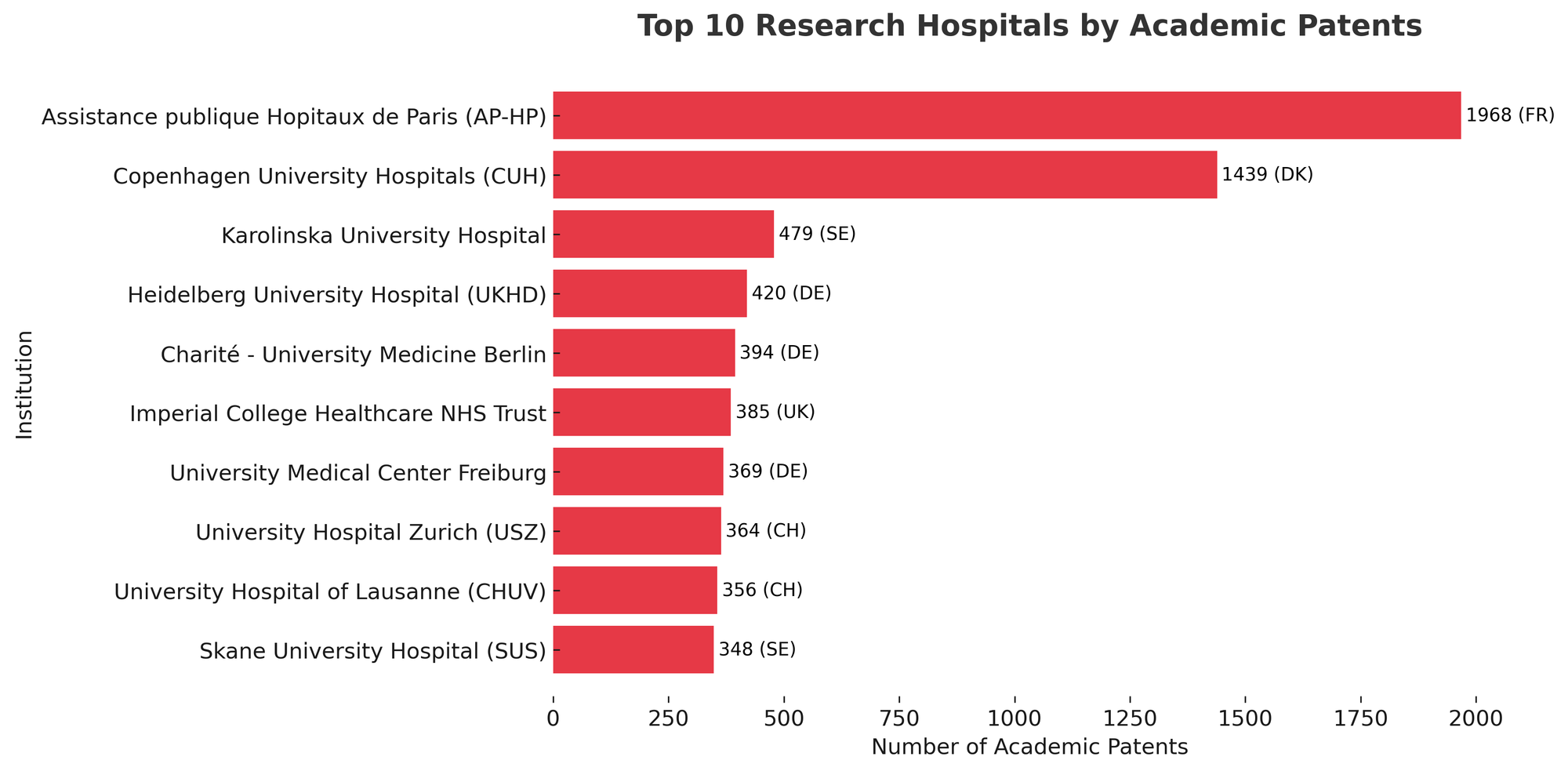

Research hospitals have seen major growth, with European hospitals filing about 17,400 patent applications from 2001 to 2020 - a 50% rise - with 90% of patents concentrated in four fields: pharmaceuticals (31.3%), biotechnology (25.4%), medical technology (24.0%) and analysis of biological materials (8.4%).

EFPIA cautiously optimistic on clinical trials reform

Following the European Medicines Agency annual meeting with stakeholders to discuss how to strengthen Europe’s clinical ecosystem (ACT EU). European Federation of Pharmaceutical Industries and Associations (EFPIA), Director General, Nathalie Moll, admits to being quietly optimistic: “Whisper it: cautious optimism is in the air.”

Time is of the essence: While progress has been made under the CTR, average EU approval times still exceed 100 days, compared with 30–60 days elsewhere. Moll says that shortening these timelines, along with deeper centralization and harmonization, would make Europe far more attractive for research investment.

“Every day saved in the approval process brings innovative treatments to patients faster,” she says. “Europe has the talent and infrastructure to lead again—it just needs to move at the pace of science.”

According to Moll, the next 12 months could be decisive. “This is our chance to translate alignment into implementation,” she says. “If we act swiftly, 2026 could mark a genuine turning point for clinical research in Europe.”

Reform is converging around two key developments. The first is the EU Biotech Act, expected in two stages, with the health-related component anticipated by the end of 2025. The second is the European Commission’s evidence-gathering exercise on how the EU Clinical Trials Regulation (CTR) is performing in practice -an effort informed by a new Deloitte-led survey of sponsors, regulators and patients.

“This is about learning from experience,” Moll explains. “By understanding what works and what doesn’t, the EU can design practical, targeted improvements that reduce timelines and complexity without compromising safety or quality.”

What we’re reading

German dependency on China: An article in Euronews, by Laura Fleischmann, paints a concerning picture. In 2024, Germany imported over 33 million tonnes of pharmaceutical products from China while exporting just 15 million tonnes back.

"The idea that factories could be brought back to Germany is political wishful thinking. The costs would be enormous and we lack the skilled labour," said Michael Müller, a professor of pharmaceutical and medicinal chemistry at the University of Freiburg.

“Germany used to be the pharmacy of the world; now the pharmacy of the world is in China or India,” says Head of the pharmacists’ association, Thomas Preis.